Table of Contents

Introduction

After the collapse of the Mauryan Empire, no such strong empire existed, which could have sustained a strong official set up to look after the matters concerning revenue administration, resulting in the emergence of intermediaries in the revenue system, which was a strong element of the feudal system. The land tenure system in the medieval India can be mainly studied under three heads:

Land Tenure System in the period 800 – I200 AD

The significant contribution in the history of land tenure system in medieval begins from Rashtrakutas. They originally belonged to Lattalura, the modern Latur of Maharashtra. In the Deccan charters of 7th and 8th centuries AD, Rashtrakutas were exhorted not to disturb the peaceful enjoyment of land grants. In most part of north India, the rural economy was termed as feudal because a major section of the surplus production from the land was appropriated by a particular section of people who claimed it as a hereditary right even though they did not participate in the production process in any way.

However, in the southern part of India, the Chola Administration had an elaborate land tenure system. A well-organized department of land revenue existed, which was known as Puravu-varitinaik-kalam. All the land was carefully surveyed and classified into tax paying and non-taxable land. The taxable land was further classified into different grades according to its natural fertility and the crops raised on it.

In Chalukya administration, the major source of revenue was land and the different land taxes to be paid were:

- Siddhaya- It was a fixed tax levied not only on land but also on houses and shops.

- Dasavanda- It referred to one-tenth portion of tax payable to authority out of the yield from the land.

- Niruni – Sunka- It was the water tax to be paid by the fanner and Melivana.

- Melivana – It was tax levied on ploughs.

Land Tenure System In Delhi Sultanate

Alauddin Khilji’s Period

The Delhi Sultanate ruler Alauddin Khalji (1296-1316) implemented a series of major fiscal, land and agrarian reforms in northern India. Some of these reforms are as follows:

Confiscation of private lands

The Delhi Sultanate included the territory governed directly by the emperor’s government, as well as the territories governed by his Vassals. The crown territory governed by the emperor was called Khalisa, and its revenues went directly to the royal treasury. The vassals (called rais, ranas and rawats) had the freedom to determine the tax rate for their subjects. Many of them were expected to maintain their own armies, and provide military support to the crown when required.

The Sultans of Delhi also made several land grants and assigned territories to their nobles as Iqta’s. The Iqta’ Holders had the right to collect taxes in their territories: the money would be used to raise a local army that would support the Sultan when needed.

As part of his land reforms, Alauddin brought a large tract of fertile land under the crown territory, by eliminating iqta’s, grants and vassals in the Ganga-Yamuna Doab region extending from Meerut to Kara. After assassinating his predecessor Jalaluddin in 1296, he had made a large number of land grants to gain support of the nobles. However, after consolidating the power, in 1297, he deposed a large number of nobles and confiscated their properties. Also after Haji Maula’s Rebellion in 1301, Alauddin decided to confiscate more private wealth as part of his measures to weaken those capable of organizing a rebellion.

He confiscated a large number of lands that had earlier been held as private property and re-designated them as part of the crown territory. He also annulled several land grants, including those awarded to religious or charitable organizations (Waqf) and those exempt from service obligations (Inam).

Direct revenue collection

Before Alauddin’s reforms, the Delhi Sultanate did not collect the land revenues directly from the peasants. The peasants surrendered the land revenues to intermediary chiefs, known as Khuts, Muqaddams, and Chaudharis, who represented villages or groups of villages. These chiefs surrendered a fixed part of the revenue to the Sultanate’s Ministry of Revenue, irrespective of how much revenue they extracted from the peasants.

Alauddin noticed that the intermediary chiefs fought against each other, flaunted their lavish lifestyle, and some of them did not remit revenues to the crown. Subsequently, his administration decided to collect the revenues directly from the cultivators. All cultivators, from the village chiefs to the peasants, had to remit half of their revenues to the crown. The village chiefs lost all their privileges.

Revenue collection both in cash and kind

Alauddin’s government accepted the revenue in both cash and kind. In the fertile regions near Delhi, the government preferred taking revenue in kind: the grain collected as a result was taken to the state granaries. The peasants were not allowed to take the surplus grain to their homes, and were compelled to sell it in the market or to the transporters at a low price.

50% tax proportional to land area

Before Alauddin’s reforms, the land revenue for each territory represented by an intermediary was fixed irrespective of the cultivation area in that territory. The fixed amount was probably based on tradition. Alauddin’s administration changed this convention, and determined the revenue amount based on the area under cultivation and the produce per biswas. This practice of determining the revenue amount based on the land area was known to the Hindu kings and was followed in southern India during Alauddin’s time. However, it seems to have fallen into misuse in northern India, and Alauddin was the first Muslim emperor of India to implement it.

Alauddin imposed a 50% kharaj (Islamic tax on agricultural land) in a substantial part of northern India. The cultivators were required to pay half of the agricultural produce as a tax: this was the maximum amount allowed by the Hanafi school of Islam, which was dominant in Delhi at that time.

Alauddin’s administration forced the village chiefs to pay the same taxes as the others and banned them from imposing illegal taxes on the peasants. The demand for tax proportional to the land area meant that the rich and powerful villages with more land had to pay more taxes. By suppressing the village chiefs, Alauddin projected himself as the protector of the weaker section of the rural society.

Other taxes

Apart from the kharaj, Alauddin’s government levied a tax on residences (called ghari) and a tax on grazing (called charai). Unlike Kharaj, these taxes were not sanctioned by the Islamic law. For the farmers with milk animals, Alauddin’s administration fixed and assigned the pastures.

In addition, Alauddin’s government imposed the Jizya Tax on its non-Muslim subjects. Women and children, as well as those with mental disorders and intellectual disability, were exempt from jizya. The Muslims were obligated to contribute Zakat instead.

Land revenue reforms of Sher Shah Suri

The historical importance of land revenue system of Sher Shah Suri (Sher Khan) lies in the fact that they lead the foundation of administration on which Akbar raised the superstructure. Todarmal, who later carried out most reforms under Akbar had gained considerable experience under former master Shershah Suri. Sher Shah’s land revenue reforms, based on wise and humane principles, have unique importance in the administrative history of India; for they served as the model for future agrarian systems. Some of his landmark reforms are as follows:

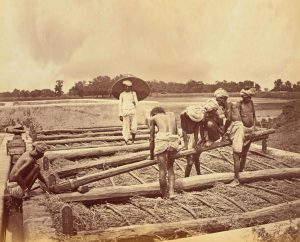

- Shershah is known to have made a systematic survey and measurement of the entire cultivable land of his empire using a unit called Sikandari Gaj. {Sikandari Gaj was introduced by Sikandar Lodi and it was equivalent to 39 inches). After a careful and proper survey of the lands, he settled the land revenue directly with the cultivators, the State demand being fixed at one-fourth or one-third of the average produce, payable in kind or cash.

- Shershah had also established the per Bigha land (Rai) for the lands under continuous cultivation (Polaj) and the lands which kept out of cultivation temporarily (Parauti). Rai was average of three rates representing good, middle and low yields. This rai system was later adopted by Akbar.

- For actual collection of revenue, the government utilized the services of the officers like the Amins, the Maqadam, the Shiqdars, the Qanungos and the Patwaris.

- During Shershah period the settlement made between the Govt. and the peasant in respect of the land revenue was always put in black and white. Every peasant was given as written document in which the share of the Govt. was clearly mentioned so that no unscrupulous officer might cheat the innocent peasant. This is known as ‘Patta’.

- During Shershah’s regime the rights of the tenants were duly recognized and the liabilities of each were clearly defined in the Kabuliyat (deed of agreement), which the State took from him, and the Patta (title-deed), which it gave him in return.

- Shershah also introduced direct remittances of the taxes to the government so that the taxpayers are saved from any exploitation by the middle officers. He also placed a survey charge of 2.5% called Jaribana and collection charge of 5% called Muhasilans.

- Remissions of rent were also made to the peasants and they also granted loans and subsidies in the time of drought and floods from the royal treasuries. Also special orders were issued to soldiers that they should not damage the standing crops in any way.

Defects In The Revenue System Of Sher Shah Suri

Sher Shah saved his country from the ill-effects of the arbitrary land revenue system and he laid the foundation of the policy of co-operation between the government and the peasants.

However, some historians and scholars point out certain defects in the revenue system of Sher Shah.

Firstly, it is pointed out that he could not completely root out the Jagirdari system which had taken deep roots in Afghan society.

Secondly, it is said that as the land revenue was fixed on the average produce of each bigha of good, average and inferior land, the owner of good land always stood to gain while owners of inferior land was always the loser.

Thirdly, it is said that as the convention of land revenue from kind to cash always depended on the Central Government, it always led to delay in the collection of land revenue.

Land Tenure System In Mughal Period

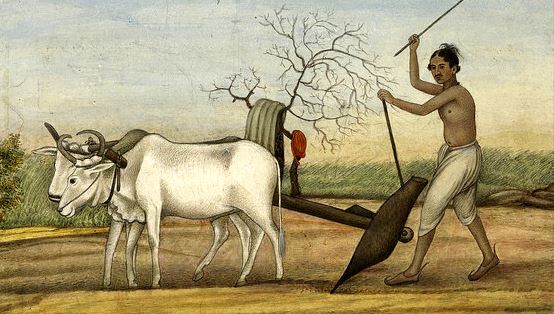

During the Mughal rule Revenue Farming was prevalent where the highest bidder was posted as the revenue collector giving him undue power over the tiller of the land. The Mughals who conquered India in the 16th century left the land to the cultivators at first in exchange for the usual taxes. Often, former small rulers were employed as tax collectors and were given 10% of the collected amount as remuneration for this work.

During the Mughal rule Emperor Akbar made significant agricultural reforms which changed the structure of Mughal economy. He followed the policy of Shershah with greater precision and correctness and then extended it to the various Subahs Or Provinces of his Empire. However the corrections done by Akbar in land revenue system can be mainly divided into three heads as follows:

Standardization Of Measurement Of The Land

In Akbar’s administration, we found so many territorial divisions and subdivisions for the first time in medieval history. For political as well as fiscal purposes Akbar had divided his empire into 15 Subahs, 187 Sarkars and 3367 Mahals. He ordered a standardization of measurement units and the so-called Ilahi Gaj was made the definite unit of land measurement. This Ilahi Gaj was equivalent to some 41 fingers (29-32 inches), and was shorter than the Sikandari Gaj (approx 39 inches) used by Shershah. The Gaj as measurement of land finds its origin during Sikandar Lodi’s times. Standardization of land measurement was adopted to brush aside all kinds of vagueness in defining the extent of land and to reduce extortion / corruption by officials.

Secondly for land measurement (Paimaish), a rope called Tenab was used in those days. Since this rope was subject to variation in its length due to seasonal dryness or humidity, Akbar made reforms in Tenab also. Instead of an ordinary rope, Akbar ordered the Tenab to be made of pieces of Bamboo joined together with iron rings. This made sure that the length of Tenab varies little during different seasons of a year.

Akbar also fixed a definite measurement to Bigha of land. A Bigha was made of 3600 Ilahi Gaj, which is roughly half of modern acre. Several Bighas made a Mahal. Several Mahals were grouped into Dasturs.

Ascertainment Of Produce Per Bigha

After the standardization of land measurement, Akbar turned towards ascertainment of the amount of produce per Bigha and the state’s share in it. Shershah Suri had already divided land into four different categories. Akbar followed the system and made a comparative estimate of the produce of lands and fixed different revenues for each of them. These four types were as follows:

- Polaj- It was the ideal and best type of land throughout the empire. This land was cultivated always and was never allowed to lie fallow.

- Parati or Parauti- This was the land kept out of cultivation temporarily in order to recoup its lost fertility.

- Chachar- It was a kind of land allowed to lie fallow for three or four years and then resumed under cultivation.

- Banjar- It was the worst kind of land that was left out of cultivation for five years or upwards.

Fixation Of State’s Share In Produce

The best lands viz. Polaj and Parauti were subdivided into three categories viz. good, middle and bad. Average produce of these three categories, called Mahsul, was taken as a normal produce per Bigha. One third of this Mahsul (average produce) was fixed as the state’s share. The Parauti land also was liable to pay the Polaj rate (one third of Mahsul) when cultivated. Chachar land was allowed to pay a concessional rate until it was cultivated again to be liable to pay the Polaj rate. Banjar lands were also not totally neglected.

Further, the peasants were given the option to pay either in cash or kind, whichever was convenient to them.

Fixing Rate Of Assessment

Once the land was measured and the state’s share in produce was fixed per Bigha of land, Akbar next proceeded to fix the rate of assessment. This was the most contentious part and in fact several changes were done in the system till 1585. Firstly, Akbar adopted Shershah’s Rai system in which cultivated area was measured, and a central schedule was created fixing the dues of peasants crop wise on the basis of the productivity of the land. The state’s share was fixed one-third of the produce under the schedule (Dastur-i-amal) to be paid in cash.

The peasant’s tax was based on an annual system of collecting prices and settlements of revenues for the previous years. But there were several problems with this arrangement. Therefore, Akbar ordered that the settlement should be concluded for the past 10 years. An aggregate of the rate of revenues from 1570 to 1579 was made and a decennial average was fixed as demand of the revenue. This brought certainty to collections and alleviated the problem of peasants to great extent. This was the so-called Dahsala system or Zabti System, that was implemented by Raja Todarmal.

This remained a standard system of revenue assessment during the greater part of the Mughal empire.

Land Reforms under Later Mughals

After the death of Akbar there were hardly any major reforms which were made during the Mughal rule. After Akbar, Jahangir later introduced the system of Altamgha Grant which could be annulled only by the order of the emperor. Later on when Aurangzeb became the emperor he re-adopted the policy of Alauddin Khilji and reintroduced the Jaziya Tax. Also he explicitly said that the land revenue should be appropriated according to Shariat law i.e. not more than half of the total produce. And those who were unable to pay the revenue tax their land for confiscated by the state.

After Aurangzeb’s death in 1707, the power of the central government decreased rapidly, and the control over the tax revenues was lost. In order to obtain revenues, tax collectors’ posts were leased to the highest bidders in exchange for fixed sums. Towards the end of the Mughal era, a type of “right” to land developed which was in the hands of some parasitical rent collectors who did not perform any work. But this refers to the government’s tax rights, not to a direct claim to landed property, or land utilization, on peasants’ land.

Their old saying, “Taxes are the king’s wealth, the land belongs to them” still remained valid.